$100- Billion Verizon One of Nation's Champion Tax Dodgers

A new report this week reveals how Verizon achieves a negative federal tax rate to avoid paying its fair share of taxes, and how the company aggressively uses tax loopholes and subsidies to cut its tax bills even more.

"Unpaid Bills: How Verizon Shortchanges Government Through Tax Dodging and Subsidies," (PDF) was produced by Citizens for Tax Justice (CTJ) and Good Jobs First, a national policy resource center.

The report shows that Verizon, a $100-billion corporation, paid an effective federal tax rate of -2.9 percent between 2008 and 2010. In 2010 alone, Verizon's federal tax rate was -5.7 percent. In fact, the company received a federal tax rebate of nearly $1 billion.

The report shows that Verizon, a $100-billion corporation, paid an effective federal tax rate of -2.9 percent between 2008 and 2010. In 2010 alone, Verizon's federal tax rate was -5.7 percent. In fact, the company received a federal tax rebate of nearly $1 billion.

The report is especially timely as the congressional "super committee" meets on budget and tax issues. Verizon has put the "Reverse Morris Trust" tax loophole to extensive use, avoiding $1.5 billion in taxes on the sale of its landlines and other assets, CWA Senior Director George Kohl said.

"Verizon doesn't use its tax avoidance gains to keep up its copper network or extend its fiber optic technology to cities like Boston, Baltimore, Buffalo or other communities, or create quality jobs. It isn't negotiating a fair contract with the workers who have made this company so successful," Kohl said. "Instead, it is demanding nearly $1 billion in givebacks and making sure that its top executives stay in the top 1 percent of American earners. That's why we say 'the 99 percent' are picking up Verizon's tax tab."

CTJ recently identified Verizon as one of the nation's top tax avoidance offenders, manipulating state revenue rules, seeking economic development subsidies, and structuring its business and tax affairs to produce a negative federal income tax rate. Further, Verizon has received state and local tax subsidies in at least 13 states.

CTJ Director Robert McIntyre, the report's lead author, said the billions of dollars that companies like Verizon receive are "wasted dollars that could have gone to protect Medicare, create jobs and cut the deficit. Too many corporations are gaming the system at the expense of the rest of us."

Philip Mattera, research director of Good Jobs First and also a report author, said Verizon and other tax dodgers "aren't using these tax givebacks to create good jobs or invest in their companies in ways that would improve our communities. Ordinary Americans are struggling to pay their own taxes and are picking up the tab for these corporations as well. It's a system out of control."

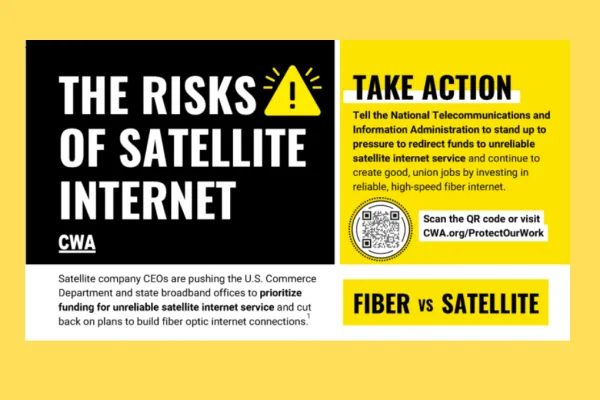

We Need Reliable Internet Service and Good Jobs - Sign the Petition

Pittsburgh Post-Gazette Strikers Win Core Demand for Healthcare

AFA-CWA United Flight Attendants Rally Across Multiple Cities