CWA Stands Up for Vital Earned Benefits

CWA members last week delivered a firm and loud message to Congress: Keep your hands off our Medicare. And while you’re at it, don’t cut Social Security or Medicaid.

Since word leaked that Democrats in the Senate are considering cuts to key earned benefit programs, our members have flooded congressional offices, delivering more than 3,300 postcards to House offices and more than 600 to the Senate. These postcards were collected by CWA’s Legislative and Political Action Teams (LPATS) during our “August Accountability” activities around the country.

Tax Our Health Care Benefits? CWA Leads the Way in Getting Congressmembers to say No Way

During the 2009-2010 battle over health care reform, CWA members and our sisters and brothers in the labor movement fought hard to keep employer-sponsored health coverage free from taxation. We were largely successful.

But now, amid renewed talk of “deficit reduction” and the efforts of the supercommittee to identify $1.2 trillion in savings, proposals to tax – and therefore cut – our health care benefits are back.

CWA has joined a bipartisan effort in Congress to prevent this from happening. We urged members of Congress to sign on to a bipartisan letter being circulated by Republican Rep. Tom Coles of Oklahoma and Democratic Rep. Joe Courtney of Connecticut. Late last week, well over 160 bipartisan members of the House signed the letter at CWA’s urging.

Since World War II, employer-sponsored health coverage has been exempt from taxable income. Today, more than two-thirds of non-elderly Americans obtain coverage through their employers. If we begin to tax these Americans’ benefits, it will disrupt the very system of employer-sponsored insurance as our nation’s primary form of health care coverage as we know it.

“And, as firms drop coverage, more and more workers would be forced into the Exchange – increasing federal spending on cost subsidies,” Coles and Courtney write. “Any cost savings derived from phasing out or eliminating the tax exclusion would be outweighed by these consequences.”

CWA is joining Coles and Courtney to ask members of the supercommittee to not recommend taxing health care benefits. The supercommittee is expected to issue its report to the full Congress by Nov. 23.

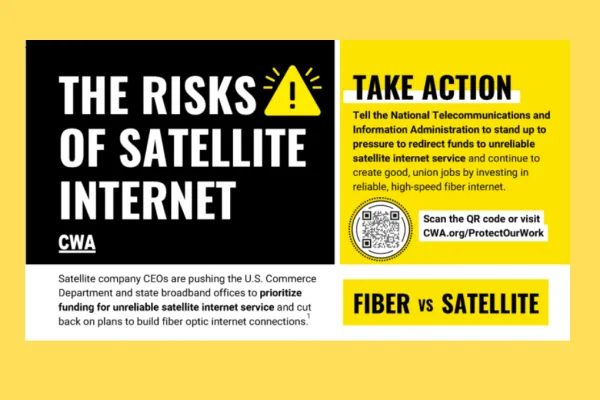

We Need Reliable Internet Service and Good Jobs - Sign the Petition

Supporting Our Members and Retirees in Texas Affected By Tragic Floods