AT&T West

October 18, 2024

Final Bargaining Report CWA District 9

CWA & AT&T 2024-2028

A Message from Your District Vice President and Your

Elected Bargaining Committees

Dear CWA District 9 Brothers, Sisters, and Siblings:

- Wages: 14.25% increase (more middle loaded) exponentially to all titles, compounded to 15.02%. FULL RETRO FOR EVERY TITLE

- Employment Security: Article 2 was maintained; pooling MOA was maintained. Additional improvements to Appendix E.

- Benefits: Maintained medical, dental, and vision. Added funded HSA (Health care spending account) for the high-deductible plan, two-tier system for medical was eliminated. Retained the SSP and 401K.

- Working conditions: Appendix E improvements, overtime cap to 12 hours, added improved double time language over 52 hours, improved notification language for schedule changes, secured a 4x10 scheduling trial and permanently added MLK day as a paid Holiday for Appendix A and E, and memorialized the 4-day work week for the call center.

- Other Goals and comments: Retained Horizons, increased tuition aid, maintained neutrality and card check along with Successorship language.

Out of the top 22 items on the survey, the following is a summary:

1. Base wage increase achieved. 12. Pension increase for retirees did not achieve.

2. Protect Healthcare achieved. 13. Maintain/improve Overtime Language achieved.

3. Retain 401K achieved. 14. Retain ESB/VSB achieved

4. Job security retained and limited improvements. 15. Improve scheduling-6 days/weekends achieved.

5. Stop movement of work did not achieve. 16. Classroom training did not achieve.

6. Eliminate Subcontracting did not achieve. 17. Maintain/Improve differentials achieved/improve App E.

7. Pension band increase yes traditional/BCB2 built in. 18. Tittle upgrades did not achieve.

8. Preserve Article 2 achieve for active employees. 19. Apprenticeship Program did not achieve.

9. Retain SSP achieved. 20. Maintain/Improve Horizons Tuition aid achieved.

10. Improve vacation and time off achieved MLK. 21. Improve expand Article 9 Safety did not achieve.

11. Retro wages achieved full retro. 22. Address The issue of New Technology achieved.

CORE Bargaining Team

Michael Barfield- Bargaining Chair, Art Gonzalez, Chris Roberts, Jason Hall, John Miller

CWA District 9 Vice President

Frank Arce

Assistant to District 9 Vice President

Domonique Thomas

Final Bargaining Report CWA District 9-AT&T

Term of Contract

The Four-year contract is effective upon ratification through April 4, 2028.

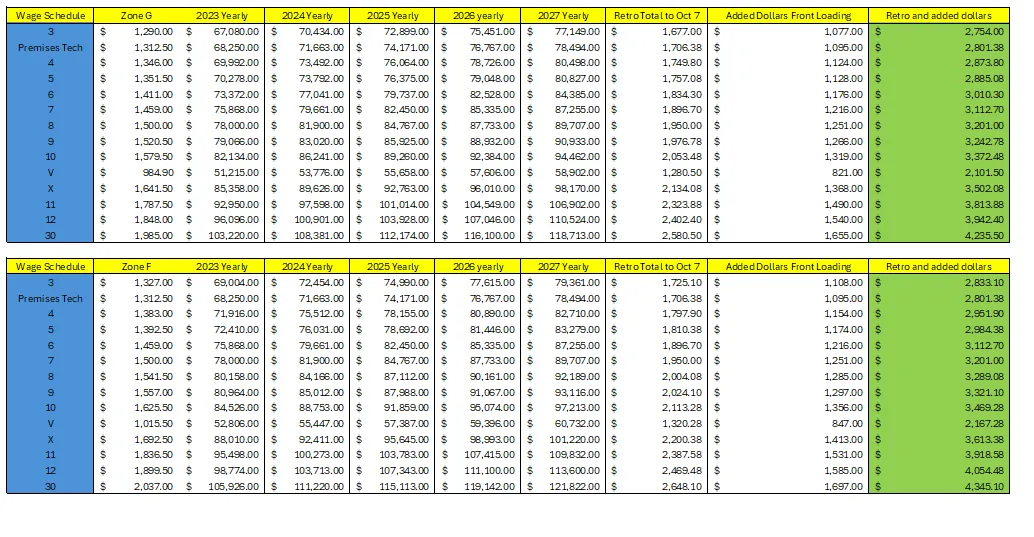

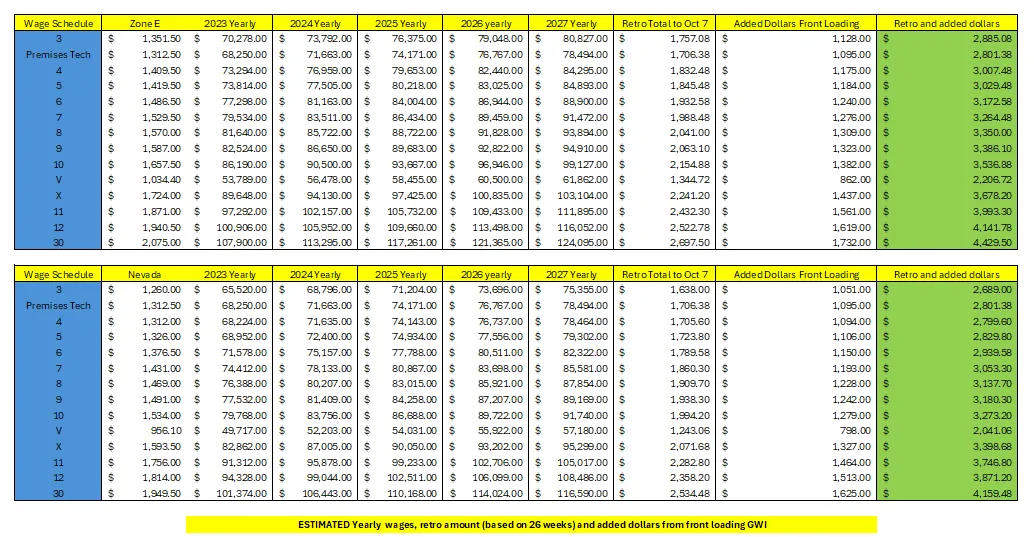

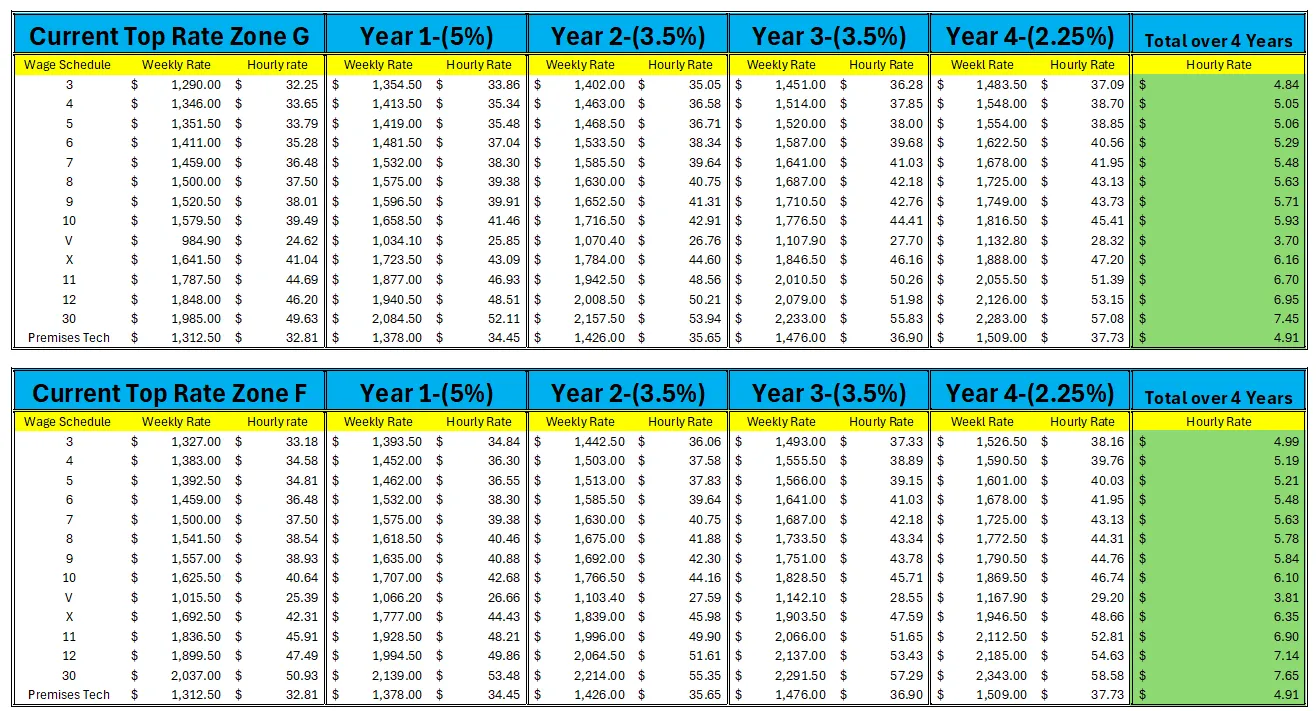

Wages and Other Compensation

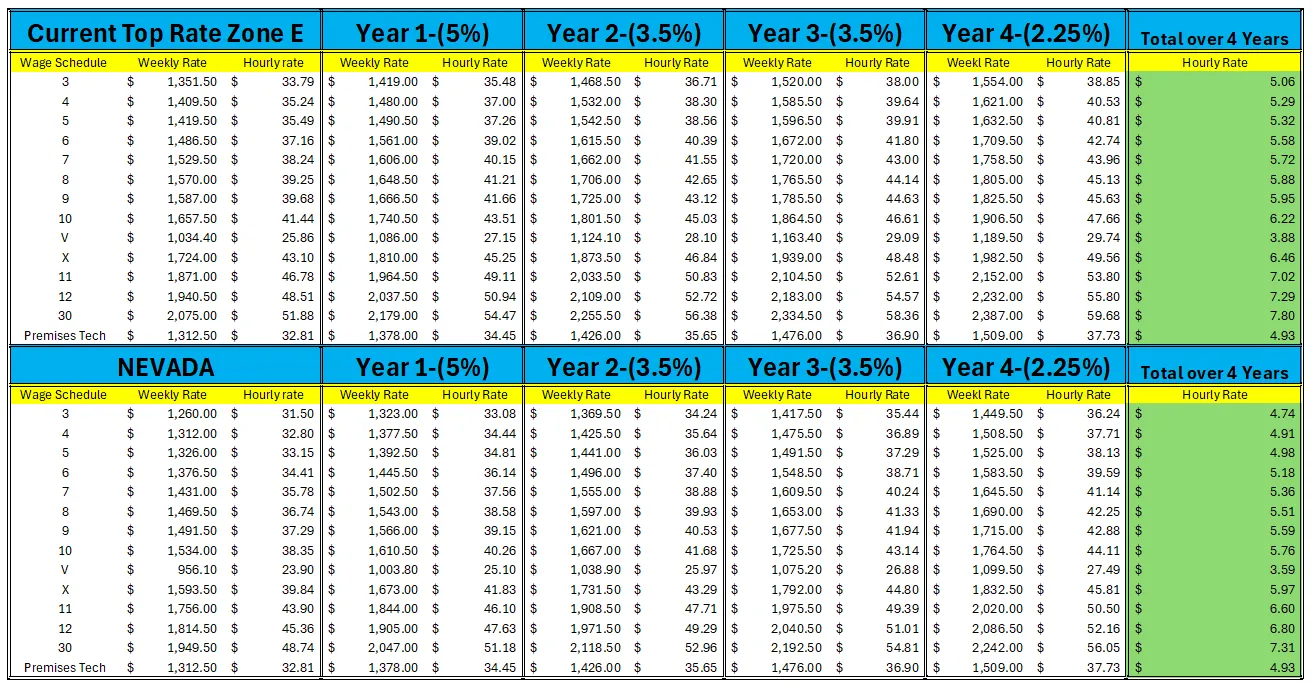

14.25% raise over life of contract for a compounded wage increase of 15.02% with FULL RETRO

The general wage increase will be effective on the following dates:

April 7, 2024 5%

April 6, 2025 3.5%

April 5, 2026 3.5%

April 4, 2027 2.25%

*See charts for specifics, but by front loading the %, each member will receive more money in the life of the contract than previously agreed to.

The wage schedules will be modified to reflect this increase, exponentialized with no change in the start rate.

Employment Security

Retained and broadened Job Security provisions:

- Maintain Article 2 for Current Employees.

- Red Circle employees over 35 years for Article 8 (ESB) Table until April 2026.

- Members over 35 years of service will have their seniority frozen until April 2026 for the purposes of surplus payout, after April 2026 members will receive a max payout of 35 years (120 weeks)

- Added Voluntary Separation Language Appendix E.

- Allows high senior employees in Appendix E to volunteer for separation if the Business declares a surplus

- Established New Separation Benefits for new hires.

- Established a new table in Article 2 for any new hires.

- Retained MOA that Sales Consultant (Leverage rep) is not applicable to a Job Offer Guarantee.

Pension Benefits

West Program:

Current Employees that continue to participate in the West Program will be eligible for the following pension band increases:

- 1.0% effective January 1, 2025

- 1.0% effective January 1, 2026

- 1.0% effective January 1, 2027

- 1.0% effective January 1, 2028

BCB2: (Covers any member hired after 2009)

- No Change. (Increases are built in Year over Year).

Lump Sum

- Lump sum distributions of monthly pension benefits were maintained.

- Bargained Cash Balance Program #2 (BCB2) of the AT&T Pension Benefit Plan No change

- Bargained Cash Balance (BCB) No change

Benefit Changes for Active Employees

***In 2025, health, dental, and vision costs will remain unchanged from 2024. This includes the same rates and plan designs for Kaiser, Option 1, and Option 2. Due to the tentative agreement's ratification date being so close to the end of the year, we will not be able to implement the new benefits until 2026. Therefore, members can expect to continue with their current coverage and rates through 2025.

Benefit Changes for Active Employees Effective 01/01/2026

Immediate medical coverage for new hires

Added two new discounted tiers to the medical plan, (individual + spouse, individual + children)

Maintained medical cost share of 29% for Company plan option 1

Kaiser Plan

Term of Kaiser Arrangement: Effective 1/1/2025 and terminates 12/31/2028.

Eligibility: Current Employees, (eliminated 2 tier health care)

Plan Design: Same terms and conditions as provided by Kaiser to Current Employees who are Eligible California Employees, subject to changes in law and the exceptions below (Kaiser Plan).

For current employees:

Plan Year 2025 2026 2027 2028

Individual ** $162 $172 $177

Individual + Spouse Partner N/A $421 $447 $460

Individual + Children N/A $275 $292 $301

Family ** $453 $481 $496

** 2025 Rates and plan design are same as 2024

If the cost of Kaiser Plan to AT&T for the Plan Year is in excess of the cost to AT&T of the Company self-insured medical plan Option 1 Broad available to Eligible California Employees, monthly contributions will apply to Eligible California Employees who are enrolled in the Kaiser Plan during the Plan Year equal to the contributions outlined above, plus the cost difference between the Kaiser Plan and the Company self-insured plan Option 1 Broad plan for the coverage tier elected.

Company Medical Plan

Monthly Contribution for all Current Employees:

Option 1 Broad:

2025 ** Same as 2024

2026 Individual $162 Individual/Spouse $421 Ind/child(ren) $275 Family $453

2027 Individual $172 Individual/Spouse $447 Ind/child(ren) $292 Family $481

2028 Individual $177 Individual/Spouse $460 Ind/child(ren) $301 Family $496

Option 1 Select:

2025 N/A

2026 Individual $142 Individual/Spouse $370 Ind/child(ren) $242 Family $398

2027 Individual $151 Individual/Spouse $393 Ind/child(ren) $257 Family $423

2028 Individual $155 Individual/Spouse $404 Ind/child(ren) $264 Family $435

Monthly Contribution for all Current Employees:

Option 2 Broad:

2025 ** Same as 2024

2026 Individual $61 Individual/Spouse $172 Ind/child(ren) $105 Family $184

2027 Individual $72 Individual/Spouse $201 Ind/child(ren) $122 Family $215

2028 Individual $70 Individual/Spouse $196 Ind/child(ren) $119 Family $210

Option 2 Select:

2025 N/A

2026 Individual $43 Individual/Spouse $120 Ind/child(ren) $73 Family $129

2027 Individual $52 Individual/Spouse $146 Ind/child(ren) $89 Family $156

2028 Individual $49 Individual/Spouse $138 Ind/child(ren) $84 Family $148

Health Savings Account for Option 2:

Employees who select Option 2 only, can elect to make pretax payroll contributions to an HSA (health savings account) up to the annual maximum set by the IRS starting in 2026

The company will match up to the below amounts for employees who elect to make payroll contributions, in an amount equal or greater than the minimum amount outlined below.

Individual: $1,000

Family: $2,000

Annual Deductibles:

Option 1:

BROAD | BROAD | BROAD | BROAD | |||||

2025 | 2026 | 2027 | 2028 | |||||

Network & ONA | Non Network | Network & ONA | Non Network | Network & ONA | Non Network | Network & ONA | Non Network | |

Ind | ** | ** | $1000 | $3000 | $1000 | $3000 | $1100 | $3300 |

Ind + Spouse Ind + Ch Family | ** | ** | $2000 | $6000 | $2000 | $6000 | $2200 | $6600

|

SELECT | SELECT | SELECT | SELECT | SELECT | SELECT | SELECT | SELECT | |

2025 | 2026 | 2027 | 2028 | |||||

Network & ONA | Non Network | Network & ONA | Non Network | Network & ONA | Non Network | Network & ONA | Non Network | |

Ind | N/A | N/A | $1000 | N/A | $1000 | N/A | $1100 | N/A |

Ind+Spouse Ind + ch Family | N/A | N/A | $2000 | N/A | $2000 | N/A | $2200 | N/A |

Note: The Annual Deductible will be included in the Out-Of-Pocket Maximums

Option 2:

BROAD | BROAD | BROAD | BROAD | |||||

2025 | 2026 | 2027 | 2028 | |||||

Network & ONA | Non Network | Network & ONA | Non Network | Network & ONA | Non Network | Network & ONA | Non Network | |

Ind | ** | ** | $3000 | $9000 | $3000 | $9000 | $3300 | $9900 |

Ind + Spouse Ind + Ch Family | ** | ** | $6000 | $18000 | $6000 | $18000 | $6600 | $19800 |

| SELECT | SELECT | SELECT | SELECT | SELECT | SELECT | SELECT | SELECT |

| Network &ONA | Non Network | Network & ONA | Non Network | Network & ONA | Non Network | Network & ONA | Non Network |

Individual | N/A | N/A | $3000 | N/A | $3000 | N/A | $3300 | N/A |

Ind + Spouse Ind + Ch Family

| N/A | N/A | $6000 | N/A | $6000 | N/A | $6600 | N/A |

** 2025 plan design is the same as 2024

Please see pages 15 - 17 for 2024 figures.

OUT OF POCKET MAXIMUMS (OOP)

OPTION 1

BROAD | BROAD | BROAD | BROAD | |||||

2025 | 2026 | 2027 | 2028 | |||||

Network & ONA | Non Network | Network & ONA | Non Network | Network & ONA | Non Network | Network & ONA | Non Network | |

Ind | ** | ** | $4,350 | $15,000 | $4,700 | $15,000 | $5,000 | $16,500 |

Ind + Spouse Ind + Ch Family | ** | ** | $8,700 | $30,000 | $9,400 | $30,000 | $10,000 | $33,000

|

| SELECT | SELECT | SELECT | SELECT | SELECT | SELECT | SELECT | SELECT |

Network & ONA | Non Network | Network & ONA | Non Network | Network & ONA | Non Network | Network & ONA | Non Network | |

Ind | N/A | N/A | $4,350 | N/A | $4,700 | N/A | $5,000 | N/A |

Ind+Spouse Ind + ch Family | N/A | N/A | $8,700 | N/A | $9,400 | N/A | $10,000 | N/A |

OPTION 2

BROAD | BROAD | BROAD | BROAD | |||||

2025 | 2026 | 2027 | 2028 | |||||

Network & ONA | Non Network | Network & ONA | Non Network | Network & ONA | Non Network | Network & ONA | Non Network | |

Ind | ** | ** | $7,500 | $22,500 | $7,500 | $22,500 | $8,000 | $24,000 |

Ind + Spouse Ind + Ch Family

| ** | ** | $15,000 | $45,000 | $15,000 | $45,000 | $16,000 | $48,000 |

| SELECT | SELECT | SELECT | SELECT | SELECT | SELECT | SELECT | SELECT |

| Network &ONA | Non Network | Network & ONA | Non Network | Network & ONA | Non Network | Network & ONA | Non Network |

Individual | N/A | N/A | $7,500 | N/A | $7,500 | N/A | $8,000 | N/A |

Ind + Spouse Ind + Ch Family

| N/A | N/A | $15,000 | N/A | $15,000 | N/A | $16,000 | N/A |

Out of Pocket Max Provisions:

If the coverage tier is Individual + Children, Individual + Spouse or Family:

In a health care plan, the out-of-pocket (OOP) maximum is the most an individual pays for covered services in a plan year before the plan starts covering 100% of eligible costs. For a family or Individual + Spouse or Individual + Child(ren) plan, each individual has their own OOP maximum. If one person in the family reaches their individual OOP max, their future medical expenses will be fully covered by the plan, even if the overall family OOP maximum hasn't been reached. Other family members would continue to contribute toward their own expenses until either they reach their individual OOP max, or the family OOP max is met.

All Current Employees:

Spouse/Partner Access to Medical Coverage Additional Medical Contribution:

Participants whose spouse/partner enrolls in AT&T-sponsored medical coverage (within either self-insured or fully insured programs) but otherwise has access to medical coverage through their employer, excluding AT&T, will pay an additional monthly contribution toward their cost of coverage. The monthly additional contribution is shown below. The participant must attest that his or her spouse/partner does not have access to medical coverage otherwise the additional contribution will be applied.

Additional Monthly Medical Contribution:

2025 2026 2027 2028

$115** $125 $130 $135

** same as 2024

All Current Employees:

Tobacco Use Additional Medical Contribution:

Employees and/or spouses/partners who use tobacco, are enrolled in AT&T-sponsored medical coverage (within either self-insured or fully insured programs) and who choose not to participate in a designated Tobacco Cessation program will pay an additional monthly contribution toward their cost of coverage. The employee and/or spouse/partners must attest to no tobacco usage or engage in a Company-sponsored Tobacco Cessation program in the time defined during Annual Enrollment otherwise the additional monthly contribution will be applied. Engagement is currently defined as

enrollment, participation and completion. A tobacco user is currently defined as someone who has used tobacco products more frequently than once a month. Tobacco products include cigarettes, cigars, pipes, e-cigarettes, vaporizers and smokeless tobacco. The definitions of engagement, tobacco user, tobacco products and the terms of the Company-sponsored Tobacco Cessation program may change from time to time, at the sole discretion of the Company.

Additional Monthly Medical Contribution for each employee and/or spouse/partner:

2025 2026 2027 2028

$75 $75 $75 $75

Wellbeing Incentive*: Starting in 2026

Up to $750 annual individual reimbursement

*Incentives for participating in the AT&T sponsored wellbeing program in 2026

Cryopreservation and Surrogacy Reimbursement.

Maximum annual reimbursement for adoptions has been increased

Dental / Vision

| DENTAL | DENTAL | DENTAL | DENTAL | |

| 2025 | 2026 | 2027 | 2028 | |

| Individual | ** | $9 | $10 | $10 |

| Individual +1 | ** | $19 | $21 | $21 |

| Family | ** | $30 | $33 | $33 |

| VISION | VISION | VISION | VISION | |

| 2025 | 2026 | 2027 | 2028 | |

| Individual | ** | $3 | $3.50 | $3.50 |

| Individual + 1 | ** | $7.50 | $9.50 | $9.50 |

| Family | ** | $12.50 | $16 | $16 |

** 2025 Rates are same as 2024

-Vision and Dental Coverage has been extended for dependents until age 26 ** starting in 2026

Prescription Drug Program (RX Plan): Starting in 2026

Changes to RX plan in 2026:

- Flat dollar copay amounts will be replaced with percentage coinsurance, meaning members will pay a percentage of the cost of the drug (Option 1 - 10%, Option 2 - 30%) up to a maximum of $50 for generics and $100 for preferred brand drugs for a 30-day supply.

- Under the Option 1 plan, the annual deductible and out-of-pocket maximum will now apply to both medical services and prescription drugs. Previously under Option 1, prescription drugs had no deductible and a separate out-of-pocket maximum.

- The Option 2 annual deductible and out of pocket maximum will continue to apply to both medical and prescription drugs.

- Maintenance drugs for chronic conditions like diabetes, asthma, hypertension and congestive heart failure will be covered without a deductible.

- New diet and weight loss medications will have expanded coverage.

All Current Employees

Option 1 Broad and Select:

Deductible: Now is Integrated with Med/Surg and MH/SA.

Retail – Network Coinsurance:

(Up to 30-day supply, Limited to 2 fills for maintenance)

2026-2028

Generic 10%

Preferred 10%

Non-Preferred 50%

Retail – Network Co-insurance Maximum

| 2025 | 2026 | 2027 | 2028 | |

| Generic | N/A | $50 | $50 | $50 |

| Preferred | N/A | $100 | $100 | $100 |

| Nonpreferred | N/A | No Maximum | No Maximum | No Maximum |

Retail – Non-Network Coinsurance:

Participants pay the greater of the applicable Network coinsurance or balance remaining after the program pays 75% of network retail cost.

Mail Order Coinsurance:

(Up to 90-day supply)

2026-2028

Generic 10%

Preferred 10%

Non-Preferred 50%

Mail Order Coinsurance Maximum:

| 2025 | 2026 | 2027 | 2028 | |

| Generic | N/A | $100 | $100 | $100 |

| Preferred | N/A | $200 | $200 | $400 |

| Non-Preferred | N/A | No Maximum | No Maximum | No Maximum |

Option 2 Broad and Select:

Deductible: Integrated with Med/Surg and MH/SA.

- - Any applicable coinsurance paid for preventive care drugs as permitted under section 223(c)(2)(C) of the IRS is not subject to the deductible

Out of Pocket Maximum – integrated with Med/Surg, MH/SA and CarePlus

Retail – Network Coinsurance:

(Up to 30-day supply, Limited to 2 fills for maintenance)

2026-2028

Generic 30%

Preferred 30%

Non-Preferred 50%

Retail – Network Co-insurance Maximum

| 2025 | 2026 | 2027 | 2028 | |

| Generic | N/A | $50 | $50 | $50 |

| Preferred | N/A | $100 | $100 | $200 |

| Nonpreferred | N/A | No Maximum | No Maximum | No Maximum |

Retail – Non-Network Coinsurance:

Participants pay the greater of the applicable Network coinsurance or balance remaining after the program pays 75% of network retail cost.

Mail Order Coinsurance:

(Up to 90-day supply)

2026-2028

Generic 30%

Preferred 30%

Non-Preferred 50%

Mail Order Coinsurance Maximum:

| 2025 | 2026 | 2027 | 2028 | |

| Generic | N/A | $100 | $100 | $100 |

| Preferred | N/A | $200 | $200 | $400 |

| Non-Preferred | N/A | No Maximum | No Maximum | No Maximum |

Disability Benefits:

Program:

2012 and 2009 New Hires and Current Employees

No Change from Current Program

2020 New Hires 2016 New Hires

No Change from Current Program

Short-Term Disability (STD):

No Change from Current Program

2012 and 2009 New Hires and Current Employees

No Change from Current Program

2020 New Hires and 2016 New Hires

No Change from Current Program

Benefit Changes for Current Retirees

No improvements. Your Union Bargaining Committee requested to bargain for current retirees, but ATT was very consistent with their response that they were not willing to bargain for current retirees, as current retiree benefits are not a mandatory subject of bargaining.

Tuition Aid:

Annual tuition aid cap for full time employees from $5,250 to $8,000.

Increase tuition lifetime caps for undergrad from $20,000 to $25,000.

Graduate from $25,000 to $30,000.

Articles

Article 1:

- 1.05 Contract distribution

Article 2:

- Established new Separation Benefits for New Hires

Article 3: No Change

Article 4: No Change

Article 5: No Change

Article 6: No Change

- Martin Luther King Jr Day

Article 7: No Change

Article 8: No Change

- Capped layoff Table at 35 Years

Article 9: No Change

Article 10: No Change

- Conclusion – Date changes

Appendices

Appendix A: No Changes

Appendix D: No Changes

Appendix E

- E1.03B Change of Hours increased from 12 to 16

- E1.03C Cancellation of Hours from 12 to 16

- E1.03D1 52-hour Double Time Rule

- E1.03D2 Mandatory overtime cap reduced from 14 to 12

- E1.03F Shift Differentials for scheduled tour hours falling between 6pm and 6am

- E1.04A Added Martin Luther King Jr Day

- E1.04L Civic Duty (employee's hours will be changed to coincide with jury duty)

- E1.05A Voluntary Resignation Program

- Scheduling trial for 4/10 consecutive O-day schedule

MOA’s / Letters

Maintained all letters except those that had expired or completed:

Improved TWP letter

Improved Wellness Program

Retained ESB

Retained Card Check

Retained Successorship

Retained GIIT (Consumer call center)

Retained Success Sharing Plan

Modified Horizon’s Training/Retraining Program

Modified Tuition Aid (Nanodegrees)

Retained National Transfer Plan (NTP)

Retained Pooling

Retained Sunday Plus Four

Retained MOA that Sales Consultant (Leverage rep) is not applicable to a Job Offer Guarantee.

Retained Company Paid Union Appointed Representative (B-Help)

Retained Wage Credit

Retained Office Closure MOA

Retained CVS Caremark letter

Retained Company Wellness Letter

Retained Technological change Moa Added Artificial Intelligence (A /I) letter

Benefits for Active Employees Effective 01/01/2025 – 12/31/2025

Kaiser Plan

Term of Kaiser Arrangement: Effective 1/1/2025 and terminates 12/31/2025.

Eligibility: Current Employees, 2009 New Hires, 2012 New Hires, and 2016 New Hires, as defined in the Benefits MOA, subject to the Agreement residing in California only (Eligible California Employees). (For Healthcare purposes, 2009, 2012, and 2016 New Hires will be considered current employees)

Plan Design: Same terms and conditions as provided by Kaiser to Current Employees who are Eligible California Employees in the plan year 2020, subject to changes in law and the exceptions below (Kaiser Plan).

For 2009 New Hires, 2012 New Hires, 2016 New Hires and Current Employees:

Plan Year 2025

Individual $156

Family $390

For 2020 New Hires:

Plan Year 2025

Individual $180

Family $450

If the cost of the Kaiser Plan to AT&T for the Plan Year is in excess of the cost to AT&T of the Company self-insured medical plan Option 1 available to Eligible California Employees, monthly contributions will apply to Eligible California Employees who are enrolled in the Kaiser Plan during the Plan Year equal to the contributions outlined above, plus the cost difference between the Kaiser Plan and the Company self-insured plan Option 1 for the coverage tier elected.

HCN Plan

Monthly Contribution for 2009, 2012, and 2016 New Hires and Current Employees:

Option 1:

2025 Individual $158 Family $394

Option 2:

2025 Individual $97 Family $268

Monthly Contribution for 2020 New Hires:

Option 1:

2025 Individual $187 Family $468

Option 2:

2025 Individual $124 Family $343

Annual Deductibles:

Option 1:

2025 | |||

Network & ONA | Network & ONA | ||

Ind | $950 | $2850 | |

Family | $1900 | $5700 | |

Annual Deductible Provisions:

No change from the current program.

Note: The Annual Deductible will be included in the Out-Of-Pocket Maximum

Option 2:

2025 | ||

Network & ONA | Non Network | |

Ind | $1750 | $5250 |

Family | $3500 | $10500 |

Annual Deductible Provisions:

No change from the current program except as provided below:

Prescription Drug Program (RX Plan):

2016, 2012, and 2009 New Hires and Current Employees

Option 1:

Deductible: None.

Out-of-Pocket Maximum:

2025 | |

| Individual | $1700 |

| Family | $3400 |

Retail – Network Co-pays:

(Up to 30-day supply, Limited to 2 fills for maintenance)

2025

Generic $10

Preferred $45

Non-Preferred $90

Retail – Non-Network Copays:

Participants pay the greater of the applicable Network co-pay or balance remaining after the program pays 75% of network retail cost.

Mail Order Copays:

(Up to 90-day supply)

2025

Generic $20

Preferred $90

Non-Preferred $180

Option 2:

Deductible: Integrated with Med/Surg, MH/SA, CarePlus

Out-of-Pocket Maximum: Integrated with Med/Surg, MH/SA, CarePlus

Retail – Network Copays:

(Up to 30-day supply, limited to 2 fills for maintenance)

2025

Generic $10

Preferred $45

Non-Preferred $90

Retail – Non-Network Copays:

Participant pays the greater of the applicable Network copay or the balance remaining after the program pays 75% of network retail cost.

Mail Order Copays:

(Up to 90-day supply)

2025

Generic $20

Preferred $90

Non-Preferred $180

The following provisions will continue to apply to Option 1 and Option 2:

- Mandatory mail order for maintenance Rx – Applies after second fill at retail.

- Specialty pharmacy program

- Personal Choice – 100% participant-paid

- Mandatory Generic

- Compound medication limitation

- Advanced Control Specialty Formulary

- New Standard Prescription Drug Formulary

- Generic Step Therapy

Yearly Wage - Retro Added (2nd TA)

Weekly Wage Breakdown (2nd TA)

Respectfully Submitted, Bargaining Committee Members

Michael Barfield - Chair, Art Gonzalez, Chris Roberts, Jason Hall, John Miller

CWA District 9 represents over 15,000 workers employed by AT&T Communications in both California and Nevada. AT&T provides both telecommunications and entertainment services, broadband subscription television services through DirecTV, combined with AT&T's legacy U-verse service for consumers and businesses.

Bargaining updates are listed below.

Sign up for bargaining updates.

Sign Up

Sign up for AT&T West bargaining and mobilization updates.

2020 Contract

View the current 2020-2024 AT&T West contract.